how to trade-in a car that is not paid off philippines

Saved Vehicles Skip to main content. Youll first need to.

:max_bytes(150000):strip_icc()/GettyImages-960436564-1e70bdcae9fa4645af0977cd4742096b.jpg)

Understanding Rent To Own Cars

The dealer will take the car as a trade-in for X amount of dollars minus the payoff on the car.

. Negative equity however may be more costly than. As mentioned earlier selling a car personally in the Philippines can help you reap up to 25 more than the price quoted by dealerships. This is a common option when people have negative equity and want to trade in their current vehicle thats not paid off.

When you want to trade in a car with an outstanding loan youll have one of these two scenarios. Not everyone has the spare cash for such an endeavor but it leaves you with a more. Then research how much your car is worth to determine what you can expect to receive if you traded it in.

Pros cons of selling it privately. It is possible to trade in a car that youre currently leasing and it works in a similar fashion to trading in one with an outstanding loan balance. Overall performance and vroom factors that make a car enjoyable to drive and ride.

But it has a few limitations. So if the car dealer gives your car a valuation of 7000 and the car has a loan payoff of 8000 for your existing loan then you will still owe 1000 on the car which inflates the cost of your new car by 1000. Trading in your car at the dealership isnt your only option.

Also the nature of business is risky. When it comes to trading nothing is 100 certain. As mentioned earlier selling a car personally in the Philippines can help you reap up to 25 more than the price quoted by dealerships.

The first thing youll need to do is find out the equity of the car. Make Up the Difference. Positive Equity Bottom line positive equity means that your car is worth more than you owe.

Car trade-in option No. The most complicated part of how to trade in a car that is not paid off arises if you find yourself with negative equity. In contrast with trading in selling the car yourself should be taken into account.

The Philippines is one of the major importers of. View Contact Us Page. Let us show you what you need to know before you get started.

Well if your answer is No then lets consider selling the car yourself. Selling a car in the Philippines. Learn how to trade in a car that is not paid off with Major World Chevrolet.

Skip to Action Bar. If your car is worth less than what you owe this is called negative equity or being underwater or upside-down on your car loan. These extra steps should include considering your cars current equity whether that equity is positive or negative and how that equity would affect the outcome of a trade-in.

Trading in a car that is not paid off is a bit more complicated than trading or selling a car that is fully paid for. The point of owning a car is to have a comfortable and functional car with everything needed. How to Trade In a Car With Negative Equity.

Paying for it and suffering in a base model unit is not the smartest option. How to Trade In a Car You Still Owe On. Cons of car trade-in.

Skip to Action Bar. Find your cars trade-in value. Pay out of pocket for the remainder of your loan balance after you apply the trade-in value.

The vehicle is registered in his name for at least six 6 months prior to shipment to the Philippines. So this will make you upside-down in your new loan. You can also sell your car to a private buyer though you may need to let your lender know first.

Knowing the value of. This is the best option as it could improve your financial situation. You can trade in a car that you still owe money on though it will take a bit more effort.

If your equity is positive you may be in a good position to trade in your vehicle even though it is not yet paid off. Contact your lender to request a payoff amount so youll know how much you still owe on your loan. The first step in trading in your vehicle is to figure out how much your car is worth.

If the trade in value of the vehicle is higher than the amount you still owe on the loan you have positive equity and that value will help reduce the cost of the car youre buyingFor example if youre buying a car for 10000 your trade-in is worth 5000 and you still owe 2000 the dealer pays off the loan and your 3000 in equity is taken off the cost of the new car. If you owe more on your current car than it is worth expect to have that difference added to the loan amount of. Rather than selling to a dealership you can get a better price for your car by selling it to a private buyer.

Skip to main content. View Contact Us Page. When financing a car it should be a unit worth the trouble not just having a car to drive.

And of course this is a good thing and will assist you in buying a. You would expect a dealer to accept a higher amount than you would have sold privately but that is not always the case. Pick out the new car you want to buy.

If you owe 12000 on your car but the dealership is only offering you 9000 for it as a trade-in that 3000 difference is going to be added into the financing terms of your new car loan. You can also solicit cash offers from dealers using the Instant Cash Offer tool. If you have positive equity this means the value of your car is worth more than the amount of the outstanding loan.

Here are your options. While it may take longer youll likely get more money for your car in a private sale than with a dealer trade-in which could help offset any negative equity. Make up the difference you still owe after accounting for the trade-in price.

Learn how to trade in a car that is not paid off with Major World Chevrolet. Bottom Line How To Trade-In A Car That Is Not Paid Off. And 60 for vehicles priced from 21 million and above.

When learning how to trade in a car you still owe on around Miamisburg you have a few different options to choose from. If you need help figuring out how to trade-in a car that is not paid off consider the following. Calculating your equity is an important but easy step.

Either way you will still be paying for a car that you traded in. As can be seen the biggest downside of this exchange is the price difference between the old car and the new one. The issue with this is transferring the amount to your new loan and can increase the monthly payment.

Solved Cost Of Goods Accounting For Used Car Dealership

Can A Debt Collector Repo Your Car Bankrate

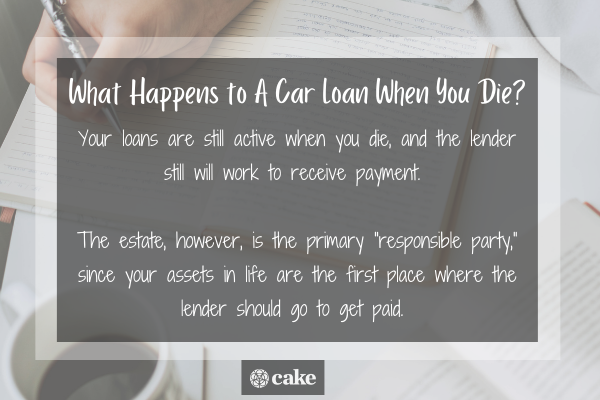

Car Loan Death Clause What You Need To Know Cake Blog

Car Loan Death Clause What You Need To Know Cake Blog

Used Car Appraisal Online Tool For Philippines Carsurvey

/car-dealer-showing-new-car-to-young-couple-in-showroom-590778115-fd7e5fcf72564de69103e9f3db58d17f.jpg)

Understanding Rent To Own Cars

Buying A Car As A Gift Here S What You Need To Know Experian

Should You Pay Off Your Car Loan Early Forbes Advisor

What Mileage Is The Best Time To Sell A Car Kings Toyota

How Interest Rates Work On Car Loans

Used Car Appraisal Online Tool For Philippines Carsurvey

How Long Does It Take To Buy A Car At The Dealer Autohitch

Paying Cash For A Car What To Know

Paying Cash For A Car What To Know

/thinkstockphotos-474354733-5bfc34e446e0fb0051bf97ba.jpg)

How Interest Rates Work On Car Loans

Paying Cash For A Car What To Know